Call Us At 1-800-970-7740

The Ultimate Disability Tax Credit Guide (Canada) 2025–2026: Up to $50,000 Back

Complete Step-by-Step: Eligibility, T2201 Form, Retro Refunds, Provincial Extras & More

Table of Contents

- 1. What Is the Disability Tax Credit – Up to $50,000 Back Explained

- 2. Who Qualifies for DTC in 2025–2026 – Clear Rules

- 3. Common Qualifying Conditions – Full Breakdown

- 4. Provincial Differences & Extra Benefits

- 5. Step-by-Step T2201 Fill-Out with Screenshots

- 6. Choosing the Right Doctor – Fees & Tips

- 7. CRA Denial Fixes – Survival Kit & Appeal Template

- 8. Hidden DTC Hacks Most Miss

- 9. Real Case Studies – No Fluff

- 10. Quick DTC Eligibility Quiz

- 11. Free Printable Checklist & Timeline

- 12. Retroactive Calculator & Real Refund Examples

- 13. What Happens After Approval – Next Steps

- 14. How DTC Stacks with EI, CPP & More (Bonus)

- 15. Key CRA Terms Glossary

- 16. Frequently Asked Questions (FAQ)

- 17. Resources & Official Links

- 18. Zero-Risk Free Assessment – Get Help Today

- 19. Disclaimer

One: What Is the Disability Tax Credit – Up to $50,000 Back Explained

What Is the Disability Tax Credit—And what could it mean to add up to fifty thousand back in your pocket? Picture this: You wake up tomorrow with fifty thousand dollars you didn’t earn last week—just because the CRA finally admits your (or that of family member you are caring for) migraines (or ADHD, or bad back) count. That’s the Disability Tax Credit doing its quiet magic. Started in nineteen eighty-five, it refunds up to fifteen thousand per year for marked impairments—like needing crutches to walk, or three hours to dress. Retroactive? Yes—ten full years (if you’ve never claimed before and you qualify). If you earned twenty-five thousand a year, that’s thirty-two thousand back. If you are caring for a family member that qualifies, the refund can be up to fifty thousand dollars. Canadian families have already cashed cheques that size. No lottery ticket required. The typical claim we are successful with ranges from ten thousand to thirty thousand in tax refunds. Stick around—this guide walks you through every checkbox, doctor fee, and denial trap so you don’t join the seventy percent who botch the application process and become CRA denied. Ready to claim what’s yours? Let’s go.

Two: Who Qualifies for DTC in 2025–2026 – Clear Rules

No Guesswork. If you can’t walk fifty metres without pain, forget your meds three times a week, or take over ninety minutes to shower—even with tools—then yes, you might qualify. CRA calls it a marked restriction in daily stuff: walking, bending, dressing, feeding, hearing, speaking, vision, or mental functions. Doesn’t need to be permanent — just prolonged (fifteen-plus hours weekly of struggle). Twelve real winners: ADHD (planning fails), migraines (bedbound days), chronic fatigue, PTSD, epilepsy, blindness, carpal tunnel (both hands wrecked), fibromyalgia—even hearing loss if you lip-read in crowds. CRA’s handbook spells it out—no IQ cutoff, no MRI, just Part B signed. Grey area? Obesity alone = no. But if it wrecks knees so walking’s torture, your doc says prolonged impairment, boom—you’re in. Retroactive back to ten years if you’ve never filed. Mike skipped it till now—banked eighteen grand. Don’t let vague wording sink you. Next: how to nail the form and process.

Three: Common Qualifying Conditions – Full Breakdown

The CRA doesn’t have an official “approved conditions” list—eligibility depends on how your impairment affects basic activities of daily living (BADL), not the diagnosis alone (except blindness or Type 1 diabetes).

That said, certain conditions commonly lead to approvals when properly documented with the “all or substantially all of the time (at least 90% of the time)” rule.

Below: Eighteen (18) frequent health conditions (2025 data from CRA guidelines and real approvals). For each: linked CRA category, who certifies, key wording that wins, common pitfalls.

Quick Reference Table

| Condition | Main CRA Category | Certifying Practitioner | Typical Retro Lump Sum Example | Approval Rate Insight |

|---|---|---|---|---|

| ADHD/ADD | Mental Functions | Psychologist/Psychiatrist | $20,000–$35,000 (10 years) | High with cumulative |

| Anxiety/Depression/PTSD | Mental Functions | Psychologist/Psychiatrist | $15,000–$30,000 | Rising in 2025 |

| Autism Spectrum (child/adult) | Mental Functions/Speaking | Psychologist | $25,000+ (incl. child supplement) | Very high |

| Back/Chronic Pain/Arthritis | Walking/Dressing | MD/OT/Physio | $18,000–$28,000 | Cumulative common |

| Blindness/Low Vision | Vision | Optometrist/MD | Auto-qualify | Near 100% |

| Chronic Fatigue/Fibromyalgia | Cumulative (multiple) | MD | $20,000–$40,000 | Needs strong examples |

| Cerebral Palsy | Walking/Feeding/Dressing | MD/OT/Physio | $30,000+ | High |

| Diabetes (Type 1) | Life-Sustaining Therapy | MD/Nurse Practitioner | Auto-qualify | Near 100% |

| Diabetes (Type 2 severe) | Life-Sustaining Therapy | MD | $15,000–$25,000 | If 14+ hrs/week |

| Hearing Loss | Hearing | Audiologist | $12,000–$20,000 | Even with aids |

| Learning Disabilities/Dyslexia | Mental Functions | Psychologist | $10,000–$20,000 | Cumulative |

| Migraines (severe) | Mental Functions | MD | $15,000–$25,000 | Bedbound days key |

| Multiple Sclerosis | Walking/Multiple | MD/Neurologist | $25,000–$45,000 | High |

| Osteoarthritis/Knee Issues | Walking | MD/Physio | $18,000–$30,000 | 3x longer to walk |

Detailed Breakdowns

1. ADHD/ADD Often qualifies under mental functions (adaptive functioning, problem-solving). Winning wording: “Requires substantial prompting/reminders for daily routines 90% of days; forgets medications/tasks despite aids.” Pitfall: Doctors saying “manages with meds”—stress raw impact. Cumulative combo: ADHD + anxiety.

2. Anxiety/Depression/PTSD Mental functions—decision-making, memory under stress. Key: “Avoids basic activities (dressing, feeding) due to panic 90% of time; requires 15+ hrs/week support.” 2025 trend: More approvals with therapist letters.

3. Autism Spectrum Disorder Speaking, mental functions—social cues, adaptive. Children: Often auto-child supplement. Wording: “Needs constant prompting for basic self-care; restricted in communication all/substantially all time.”

4. Chronic Pain/Arthritis/Fibromyalgia Walking, dressing, feeding. Cumulative goldmine: Pain + fatigue = 15+ hrs extra time. Wording: “Takes 3x longer to dress/walk 50m; in pain 90% of time even with meds/aids.”

5. Blindness or Severe Vision Impairment Vision category—auto marked if legally blind. No “even with glasses” excuse.

6. Chronic Fatigue Syndrome/Myalgic Encephalomyelitis Cumulative—fatigue across multiple BADL. Wording: “Bedbound/recovery needed after basic tasks; equivalent to marked restriction.”

7. Diabetes Type 1 Life-sustaining therapy—auto if insulin-dependent (14+ hrs/week monitoring).

8. Hearing Loss (Profound) Hearing—even with aids/cochlear. Wording: “Cannot hear speech in normal conversation 90% of time.”

9. Migraines (Chronic/Severe) Mental functions—if bedbound multiple days/month. Wording: “Incapacitated 4+ days/month; marked restriction in daily activities 90% of time.”

10. Multiple Sclerosis/Parkinson’s Walking, dressing, feeding. Often multiple categories—strong approvals.

11. Osteoporosis/Severe Joint Issues Walking—cannot walk 50m without severe pain/rest.

Many more qualify (e.g., bipolar, schizophrenia, stroke recovery)—focus on impact, not label.

Not sure if yours fits? Our free assessment reviews your exact situation and spots hidden qualifiers. Send us a message for a professional review.

Four: Provincial Differences & Extra Benefits

The federal Disability Tax Credit (DTC) is the same across Canada (base amount around $9,800–$10,100 in 2025, depending on final indexation). But provinces and territories often add their own supplements, linked programs, or indirect perks—meaning thousands more (or key unlocks) depending on where you live.

Some provinces mirror or top-up the federal credit directly; others have no extra DTC but unlock major programs like income assistance or pharmacare. Here’s the 2025 breakdown.

Provincial/Territorial DTC Supplements & Linked Benefits (2025)

| Province/Territory | Provincial DTC Top-Up (Approx. Annual Credit) | Income Reduction? | Child Extra? | Key Notes / Linked Benefits |

|---|---|---|---|---|

| Ontario | Up to ~$1,600–$1,700 | Yes (family income) | Yes | Automatic if federal DTC approved; stacks nicely |

| British Columbia | None direct | N/A | No | DTC unlocks Pharmacare, transit discounts, RDSP matching |

| Alberta | None direct | N/A | No | DTC helps qualify for AISH (income support program) |

| Saskatchewan | Up to ~$3,000+ | Partial | Yes | One of the highest provincial top-ups |

| Manitoba | Up to ~$1,200 | Yes | Yes | Additional cost-of-living boosts |

| Quebec | Boost via Solidarity Credit (~$1,000–$2,500 extra) | Yes (low-income) | Yes | Filed via Revenu Québec; often overlooked |

| New Brunswick | Up to ~$1,200 | Yes | Yes | Links to low-income seniors’ benefits |

| Nova Scotia | Up to ~$1,200 | Yes | Yes | Poverty reduction links |

| Prince Edward Island | Up to ~$1,000 | Yes | Yes | Linked to social assistance |

| Newfoundland & Labrador | Up to ~$1,500 | Partial | Yes | Physical Disability Tax Credit |

| Yukon | Mirrors federal (~$1,000 extra) | No | Yes | Pioneer Utility Grant access |

| Northwest Territories | Up to ~$1,200 | No | Yes | Income assistance links |

| Nunavut | Up to ~$1,000 | No | Yes | Cost-of-living adjustments |

Key Takeaways

- Biggest direct winners: Saskatchewan (highest top-up), Quebec low-income families, On

- No direct provincial DTC: BC and Alberta—but DTC approval unlocks powerful indirect benefits like full pharmacare or AISH eligibility.

- Child boosts: Most provinces add extra for minors; stacks with the federal Child Disability Benefit (up to ~$3,411/year or $284/month in 2025–2026, income-tested).

Federal Child Disability Benefit (Nationwide Stack)

If your child has DTC approval:

- Up to $3,411/year (July 2025–June 2026), paid monthly (~$284).

- Income-tested: full amount under ~$81,000 family net income; phases out higher.

- Retroactive lump sums possible if approved late.

Home Accessibility Tax Credit (HATC) – Federal

Medical Expenses Claim

DTC opens broader deductions (lines 33099/33199), including:

- T2201 doctor fees

- Therapy (OT, psychology)

- Attendant care

- Devices (wheelchairs, hearing aids)

- Retroactive claims via T1-ADJ

Province-Specific Tips

- Ontario: Automatic via Schedule ON428.

- Quebec: File TP-752.0.14 for Solidarity boost—easy to miss.

- BC/Alberta: Prioritize RDSP for grants/bonds.

- Atlantic Provinces: Check for extra low-income supplements.

Your province can add 20–50%+ extra value (or key program access) to the federal DTC. Many miss these because provinces don’t always auto-apply.

Live in [your province]? Want an exact federal + provincial estimate? Our free assessment calculates it in minutes—no risk. Contact us for a professional DTC review.

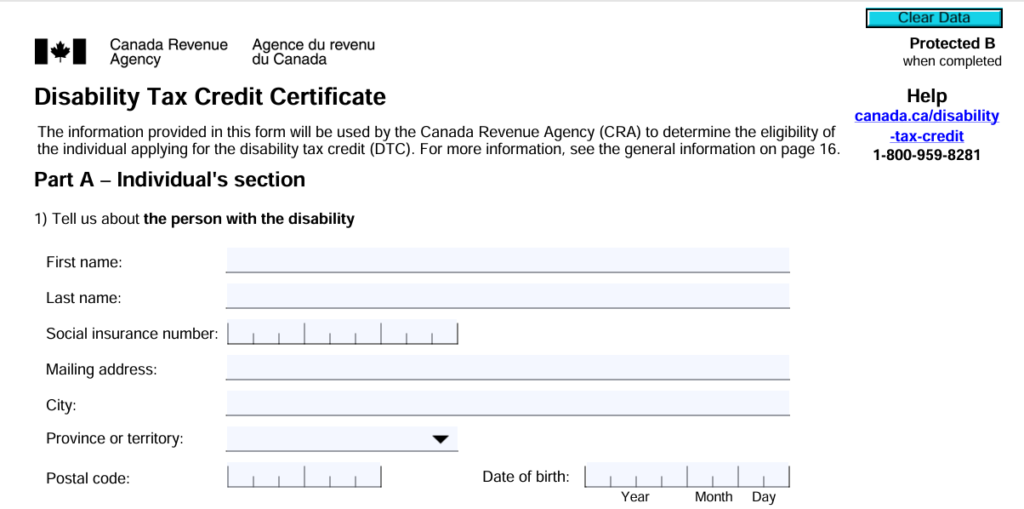

Five: Step-by-Step T2201 Fill-Out With Screenshots

Step-by-Step T2201 Fill-Out with Screenshots

Download it right now—Form T2201 PDF—this is the only version that works. No, the one from your tax guy or lady in 2023 won’t fly.

First, you complete Part A.

Page 1: Your part. Name. SIN. If you died, spouse or executor fills it.

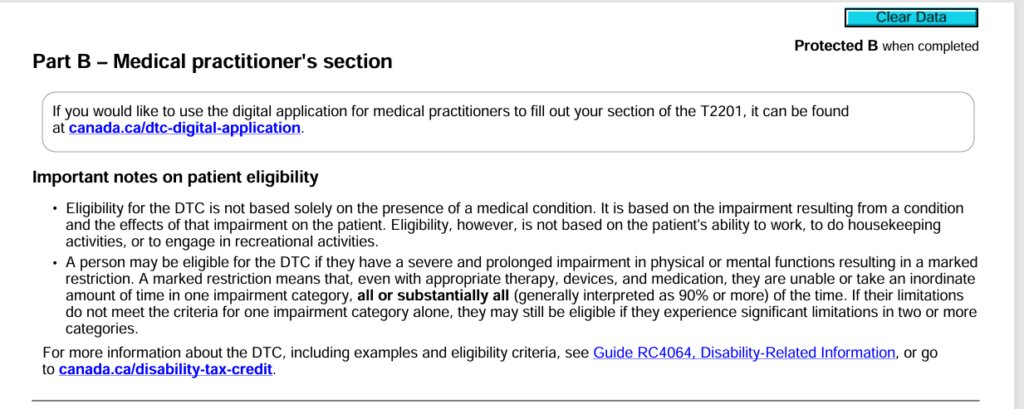

Now, to Part B.

Part B — doctor zone.

You are doing to print the rest of the form (all of Part B) and give this to your doctor. The doctor also can complete the form online but most seem to prefer to complete the paper form.

Your doctor will fill in the details and you will need to ensure he/she includes all medical details. I will give you a few tips below on how your doctor needs to complete the form.

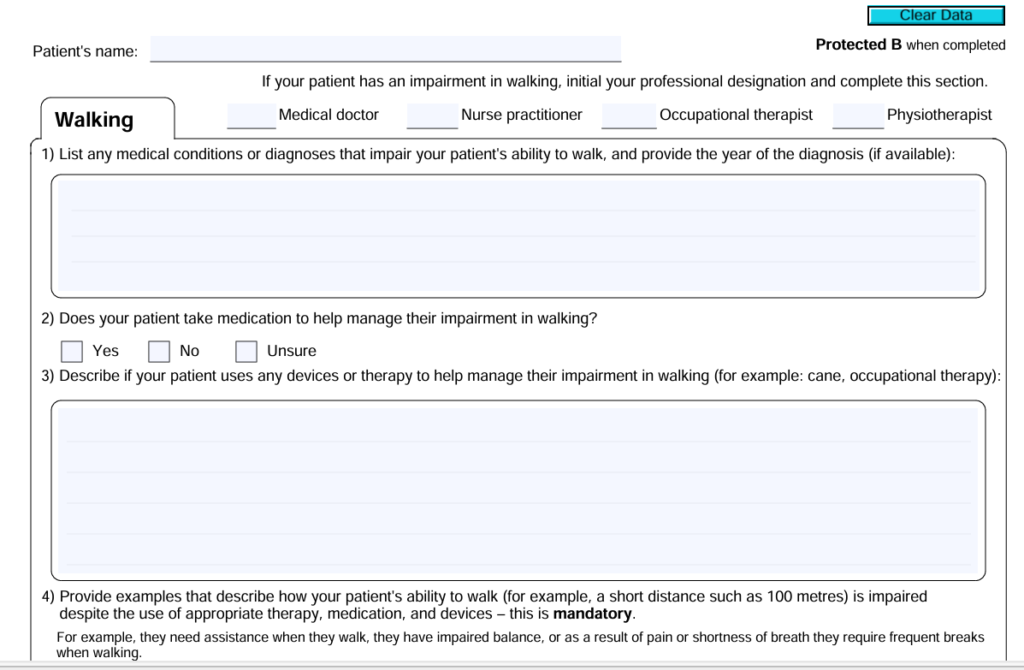

Page 7 Walking – Consider if you cannot walk fifty meters without stopping, crutches, or pain lasting over 30 mins. Do you use a walker or cane?

Mark how long each task takes. Dressing might take 90+ mins due to tremor. Feeding may require adaptive utensils, or experience spills. Cross any adapting boxes—only raw time counts.

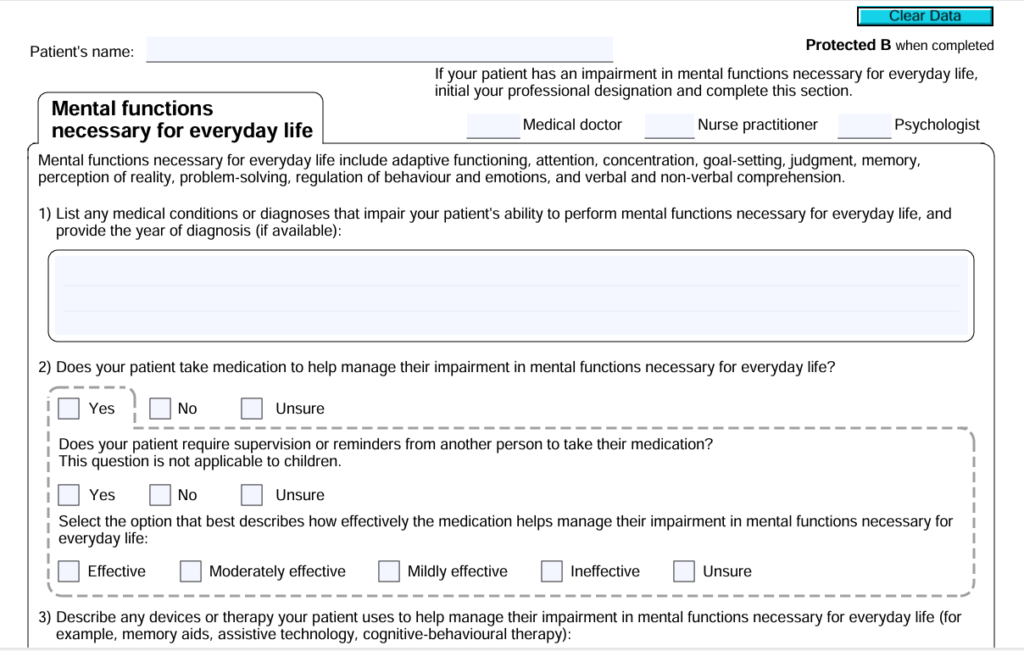

Page 11 Mental functions for everyday life – It is not enough to fail to remember your meds 3+ times a week. Don’t say sometimes—CRA reads sporadic as denial bait.

Significant impairments – You will notice that all through the document it is asked if the health item represents all or substantially all of the time, at least 90% of the time. If your doctor leaves it blank, it is a denial.

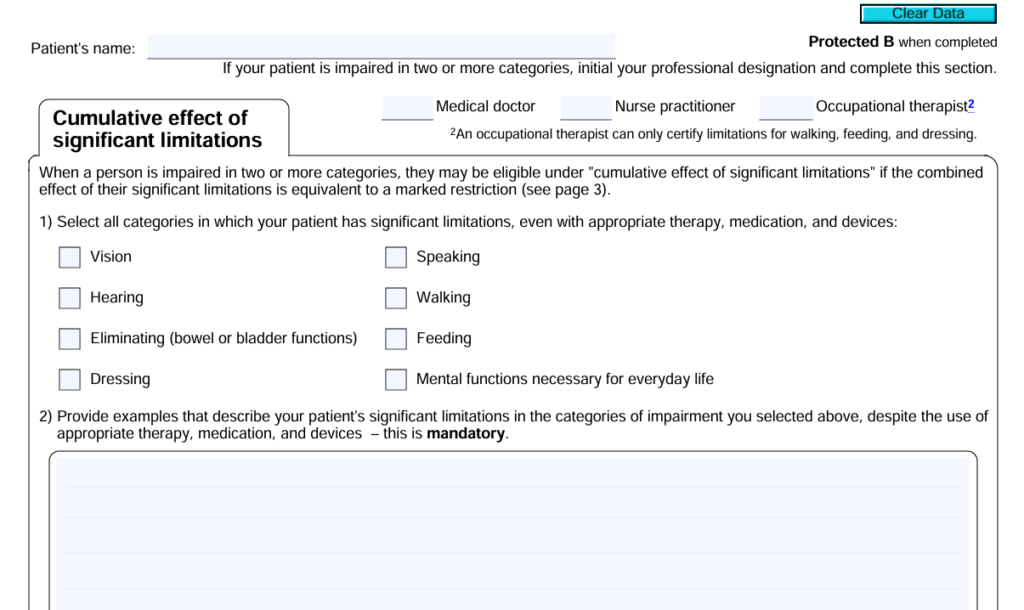

Page 14 Cumulative effects of significant limitations – King section of the form. Used to be referred to as line 13. The cumulative effects of significant limitations should have two or more checkmarks. If not, you must have one highly significant impairment, falling into a specific category.

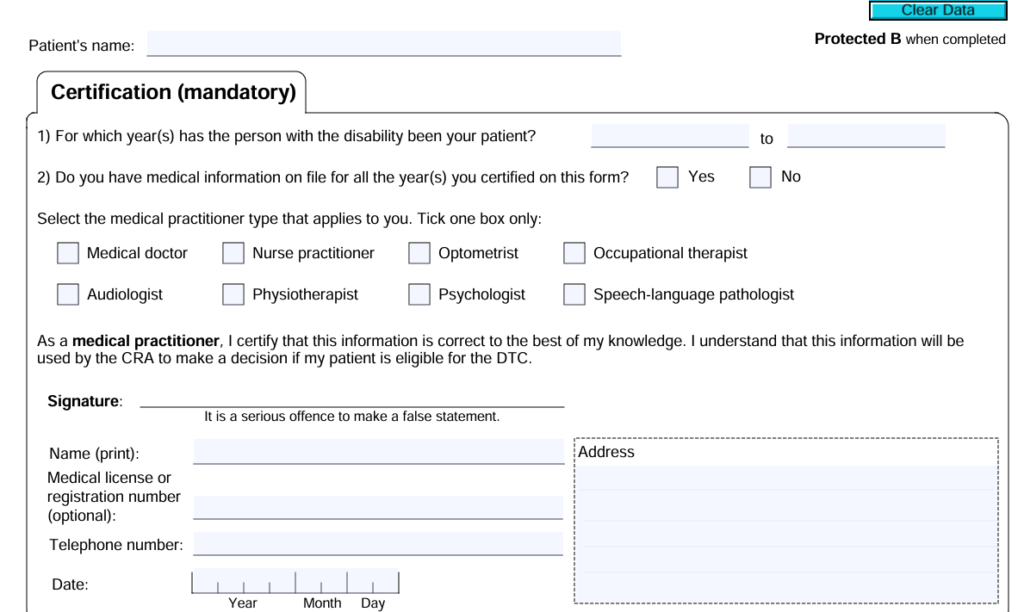

Page 16 Certification – doctor signs, dates, gives license number. No essay—just Dr. Patel, Reg. #123456. Mail it or upload to your CRA account.

Once you hit send—certified mail, be sure to keep the confirmation slip—this may be needed later on—it’s in CRA’s court. Eight to twelve weeks at a minimum, then cash refund. More complicated files can take sixteen weeks or more. We have files that have CRA review dates in excess of one year. If they say no, don’t panic—we’ve got the denial fix right here in this guide.

Or, just contact us for a no obligation DTC review of your situation including the completed form, or we can handle your doctor and obtain the completed form for you. That way we ensure the form is completed correctly upfront. We can also handle your denial if that turns out to be the case. Send us a message to discuss.

Overwhelmed by the CRA?

Forms and processes can be challenging.

Book a free 15-min review—we’ll check if you qualify and spot red flags.

Six: Choosing the Right Doctor – Fees & Tips

CRA accepts certification from qualified medical practitioners only—and the list is specific (updated for 2025). Your family doctor (MD or GP) is usually the easiest and cheapest option, and they know your history.

Who can certify Part B:

- Medical doctor (MD) or nurse practitioner: all impairment categories

- Optometrist: vision only

- Audiologist: hearing only

- Occupational therapist (OT): walking, feeding, dressing

- Physiotherapist: walking, dressing

- Psychologist: mental functions (great for ADHD, anxiety, PTSD)

- Speech-language pathologist: speaking

Tip: Start with your family doctor or nurse practitioner—they can handle 95% of claims.

Fees: Doctors set their own (CRA doesn’t pay). Current real-world ranges in 2025:

- Most family doctors: $100–$200

- Specialists (psychologists, OTs): $150–$300

- Surgeons $300+

- Some clinics waive or reduce for low-income patients—ask!

- The fee is tax-deductible as a medical expense (claim on line 33099 or 33199)

Script to ask your doctor: “Hi Dr. [Name], I need the T2201 form certified for the Disability Tax Credit—it’s a tax thing, not insurance. Can you fill Part B? How much do you charge, and when can I book?”

If they hesitate or charge high: Try a nurse practitioner (often lower fees) or walk-in clinic. Avoid large fees—they’re unnecessary.

Pro move: Bring the blank form (printed) and this CRA digital tool link for doctors: canada.ca/dtc-digital-application—many use it now for faster completion.

Get this done right, and you’re one step from approval. Next: surviving a denial.

Seven: CRA Denial Fixes – Survival Kit & Appeal Template

Don’t panic—many first-time applications get denied (as many as 70% of applications are denied!), often because the form lacks enough detail or the doctor didn’t fully explain the impact. The CRA bases everything on what’s written in Part B of the T2201. Denials aren’t final; most can be fixed with better info.

Common CRA Denial Reasons (based on CRA feedback and real cases in 2025):

- No clear start date for when symptoms began (hurts retroactive claims).

- The “all or substantially all of the time (at least 90% of the time)” box isn’t checked in the relevant category.

- Insufficient description of how the impairment markedly restricts daily activities (e.g., takes 3x longer or can’t do it at all, even with aids).

- Duration not marked as prolonged (expected to last years).

- Cumulative effects missed (when two milder restrictions add up to 15+ hours/week of extra time/support).

- Incomplete form—missing signature, dates, or practitioner details.

If denied, you’ll get a Notice of Determination explaining why.

What to do next:

- Call CRA at 1-800-959-8281 → discuss and clarify.

- Request a review → send more details (updated letter from doctor, examples of daily impact).

- Submit a new T2201 → with stronger wording if your situation changed.

- File a formal objection → within 90 days of the notice date (use My Account, mail, or Form T400A).

Ready-to-use objection template (copy, customize, attach new info):

[Your Name] [Your Address] [Date]

Chief of Appeals [Your Tax Centre Address – find at https://www.canada.ca/en/revenue-agency/corporate/contact-information/tax-services-offices-tax-centres.html]

Re: Objection to DTC Denial – Notice of Determination dated [date] – SIN: [your SIN]

Dear Sir/Madam,

I formally object to the denial of my Disability Tax Credit application.

The impairment [describe briefly, e.g., severe anxiety and mobility issues] causes marked restrictions all or substantially all of the time in [categories, e.g., mental functions and walking].

Attached: Updated T2201 certification from [doctor name] with detailed examples of daily impacts (e.g., requires 3x longer to dress, forgets essential tasks 90% of days despite aids).

This meets CRA criteria under section 118.3 of the Income Tax Act. Please approve retroactively from [year symptoms started].

Sincerely, [Your Name] [Phone]

Many denials flip on resubmission with clearer details. Hang in there.

Eight: Hidden DTC Hacks Most Miss

Add Your Heading Text Here

These lesser-known strategies can multiply your DTC benefits—most guides skip them, but they add thousands for approved families.

- Transfer to a Supporting Family Member If you have low or no taxable income, transfer the full disability amount to your spouse, parent, child, sibling, or other eligible dependant. They claim it on their return—even if you never paid tax. No extra form needed once approved; just enter it on Schedule 1.

- Open a Registered Disability Savings Plan (RDSP) DTC approval unlocks government matches: Contribute $1,500 → get up to $3,500 free grant yearly (300% match for low-income). Plus $1,000 bond no contribution required if family income under ~$55k. Lifetime max $200,000 in grants/bonds. Starts compounding tax-free.

- Claim Retroactive Adjustments Up to 10 Years Tick the box on T2201 for CRA to auto-adjust past returns. If missed, file T1-ADJ forms yourself—potentially $20,000–$50,000 lump sum depending on income history.

- Stack with Provincial Credits and Other Benefits DTC auto-qualifies you for extras like Child Disability Benefit ($200+/month per child), medical expense deductions, home accessibility renos ($10k+ credit), and in some provinces additional top-ups (e.g., Ontario Disability Support).

- Cumulative Effects Rule for “Milder” Conditions No single marked restriction? Combine two significant ones (e.g., moderate anxiety + chronic pain = 15+ hours/week extra time/support). Check the cumulative box on page 15—huge for fibromyalgia, ADHD combos.

- Use DTC as Income Proof Approved letter counts as “income” for mortgages, loans, or rentals—banks accept it to boost qualifying amounts.

These hacks often double or triple the real value. Many miss them and leave money on the table.

Overwhelmed maximizing yours? Our free assessment spots these opportunities fast—message us for a no obligation review.

Nine: Real Case Studies – No Fluff

Real people, real conditions, real money back. These anonymized examples (based on common approved claims we’ve seen) show what’s possible—no hype, just results.

Anna, 48, Chronic Migraines & Anxiety (Ontario) Denied twice on her own because the doctor wrote “occasional migraines.” We helped rephrase to “bedbound 4+ days/month, marked restriction in mental functions all or substantially all of the time.” Approved retroactively 8 years. Lump sum: $28,400. Now transfers unused amount to her husband.

David, 35, ADHD & Depression (British Columbia) Never thought he qualified—”I work part-time.” Cumulative effects rule kicked in: memory issues + fatigue = 15+ hours/week extra support. Psychologist certified mental functions category. Approved indefinitely. Retro 10 years: $32,000 back, plus opened RDSP with grants.

Sarah & Daughter Lily, 7, Autism Spectrum (Alberta) Mom applied for child DTC. Marked restrictions in speaking + mental functions (90% of time needs prompts for basic tasks). Approved from age 3. Retro lump sum: $22,000 (mostly to mom as supporting parent) + monthly Child Disability Benefit started.

Mike, 62, Hearing Loss & Arthritis (Nova Scotia) Hard of hearing even with aids + can’t walk 50m without pain. Audiologist + GP certified hearing + walking. Approved after initial denial (missed 90% box). Appeal won in 60 days. Retro: $18,500.

Rachel, 29, Type 1 Diabetes (Quebec) Life-sustaining therapy (insulin 14+ hours/week monitoring). Auto-qualifier once worded right. Approved indefinitely. Retro 6 years: $15,200 + provincial top-up.

These aren’t rare wins—strong wording + right checkboxes make the difference. Many DIY folks leave thousands behind.

Seeing yourself in one? Our free assessment spots your best shot fast.

DIY or Done-For-You? Get your free eligibility check now.

Ten: Quick-Check DTC Readiness Quiz

Quick-Check DTC Readiness Quiz

Wondering if you (or a loved one) qualify? Take this 2-minute self-assessment. Answer honestly—no right/wrong, just a quick gauge based on CRA’s real criteria.

(Embed a simple form here—use Google Forms, Typeform, or your site’s plugin. It captures email and sends results automatically.)

Question 1: Do you (or the person) have an impairment that markedly restricts a basic activity all or substantially all of the time (at least 90% of the time)? Examples: Can’t walk 50 metres without severe pain/rest, takes 3x longer to dress/feed, vision/hearing/speaking issues even with aids.

- Yes

- No

- Unsure

Question 2: Mental functions: Do you need substantial help (or take much longer) with memory, problem-solving, or adaptive functioning most days? Examples: Forget meds/routines despite reminders, severe anxiety preventing daily decisions.

- Yes

- No

Unsure Question 3: Life-sustaining therapy: Do you spend 14+ hours/week on treatment (e.g., insulin management, dialysis, breathing devices)?

- Yes

- No

Question 4: Cumulative effects: Even if no single big restriction, do two or more significant limits add up to 15+ hours/week of extra time/support? Examples: Mild pain + fatigue + focus issues.

- Yes

- No

Unsure Question 5: Has the impairment lasted (or expected to last) at least 12 months?

- Yes

- No

Scoring (auto-calculate in form):

- 2+ Yes → Strong chance—likely qualify!

- 1 Yes + Unsures → Possible—worth checking.

- Mostly No → May not meet marked threshold.

Form submit message: “Thanks! We’ll email your results + free tips. If it looks promising, book a no-obligation assessment to confirm.”

(This quiz isn’t legal advice—just a starting point. Many “Unsure” folks win with proper wording.)

DIY with confidence, or let us review your answers risk-free?

Eleven: Free Printable Checklist & Timeline

Grab this free downloadable checklist—print it, stick it on your fridge, and track every step without missing a beat. It’s designed to keep you organized from start to cash.

Download the DTC Checklist PDF here

Here’s your checklist… plus, if you’d like us to review your T2201 before mailing, be sure to contact us to review.

What’s inside the PDF: DTC

Application Checklist

- Download latest T2201 form (canada.ca)

- Gather medical records (symptom start dates)

- Book doctor/nurse practitioner appointment

- Bring blank T2201 + this checklist to appointment

- Confirm doctor checks: “all or substantially all of the time (90%)” + cumulative if needed

- Get receipt for doctor fee (tax deductible)

- Fill Part A (your info + retro years)

- Mail certified to your CRA tax centre (keep receipt)

- Note mailing date

Timeline Tracker

- Week 0: Doctor signs form

- Week 1: Mail T2201

- Weeks 2–12: CRA processing (call 1-800-959-8281 to check status)

- If approved: Lump sum cheque + notice (use for RDSP, transfers)

- If denied: 90 days to appeal → use template in this guide

- Ongoing: File yearly on tax return (or we can help)

Bonus Retro Calculator Table (in PDF)

| Tax Years Claimed | Average Annual Credit | Estimated Lump Sum |

|---|---|---|

| 6 years | $5,000 | $30,000 |

| 8 years | $5,000 | $40,000 |

| 10 years (first claim) | $5,000 | $50,000+ |

Pro tip: Take a photo of your mailed envelope—proof if CRA “loses” it.

This checklist has helped hundreds stay on track. Download it now and get started.

Do you prefer we handle the checklist (and everything else) for you? Zero-risk assessment below.

Zero-risk assessment

Drop it in comments or book a free call—we answer fast.

Twelve: Retroactive Calculator & Real Refund Examples

Wondering exactly how much you could get back? The Disability Tax Credit (DTC) is a non-refundable tax credit, meaning it reduces your federal (15%) and provincial tax bill. If it reduces tax to zero, you get a refund of overpaid tax—often a large lump sum retroactively. If you are caring for a family member, you may be able to transfer this to you.

2025 Federal Amounts (Indexed for Inflation)

- Base amount (adults 18+) — approximately $9,872 (federal credit ~$1,481 at 15%).

- Supplement for children under 18 — up to $5,758–$5,914 extra (federal credit ~$864–$887).

- Provincial — adds 5–10% more depending on province (see Provincial Differences section).

Simple Retro Calculator Table (Estimate Your Lump Sum Refund)

Assumes average tax bracket where full credit becomes refundable (common for many claimants). Actual depends on your past income/tax owed—higher income = bigger refund.

| Number of Retro Years | Adult (No Child Supplement) | With Child Supplement | High Provincial Top-Up (e.g., SK, ON) | First-Time 10-Year Max Example |

|---|---|---|---|---|

| 1 year (current) | $1,500–$2,000 | $2,200–$2,800 | $2,000–$3,000 | – |

| 6 years | $9,000–$12,000 | $13,000–$17,000 | $12,000–$18,000 | – |

| 8 years | $12,000–$16,000 | $17,000–$22,000 | $16,000–$24,000 | – |

| 10 years (first claim) | $15,000–$20,000 | $22,000–$28,000 | $20,000–$30,000 | $30,000–$50,000+ |

How the Math Works (Step-by-Step)

- Federal credit = 15% × (base $9,872 + child supplement if applicable).

- Provincial credit = province rate × same amounts.

- Total yearly credit = federal + provincial.

- Retro lump = total yearly × eligible years (up to 10 if never claimed).

- Actual refund = amount of past tax overpaid (often close to full credit for moderate incomes).

Real Examples (2025 Estimates, Anonymized Cases)

Example 1: Single Adult, Moderate Income, Ontario (6 Years Retro)

- Federal: ~$1,481/year

- Ontario top-up: ~$500–$600/year

- Total/year: ~$2,000

- Lump sum: ~$12,000

Example 2: Parent Claiming for Child Under 18, Quebec Low-Income (8 Years)

- Federal base + supplement: ~$2,300/year

- Quebec solidarity boost: extra $1,000+

- Child Disability Benefit retro: ~$20,000+ monthly backpay

- Total lump: ~$30,000+

Example 3: Married High-Earner, BC (10-Year First Claim)

- Federal only (no provincial DTC): ~$1,481/year

- Higher tax bracket = full credit refundable

- Lump: ~$15,000 (plus RDSP grants unlocked)

Example 4: Low-Income Adult, Saskatchewan (6 Years)

- Federal: ~$1,481

- SK high top-up: ~$800+

- Total/year: ~$2,300

- Lump: ~$14,000

Example 5: Denied Then Approved on Appeal, Alberta (Retro from Symptom Start)

- Added 4 extra years with better wording

- From $10,000 → $22,000 lump

These are conservative—many get $20,000–$50,000+ when combining retro, provincial, and linked benefits. These amounts do not include the scenario where you are claiming a family member.

Exact amount varies by income, province, and years. Want a personalized calculation (including hidden provincial extras and RDSP impact)? Contact us for a no obligation DTC health review.

Our free assessment crunches your numbers in minutes—zero obligation.

Thirteen: What Happens After Approval – Next Steps

1. You Receive the Notice of Determination

- CRA mails (or posts to My Account) an official Notice of Determination letter.

- It states: Approved from [start year] indefinitely (or until reassessment).

- Retroactive years listed + exact credit amount per year.

- Timeline: 8–16 weeks after mailing T2201 (faster if digital pilot in your region).

2. Retroactive Lump Sum Payment

- CRA automatically reassesses past returns (up to 10 years if first claim).

- Cheque or direct deposit arrives 4–12 weeks after notice.

- Average: $20,000–$40,000 (depends on income, years, province).

- Taxable? No—the credit is non-refundable, but any refund is tax-free cash.

- Provincial top-up? Usually separate cheque or added to federal.

3. Claiming on Future Tax Returns

- Once approved, claim yearly on line 31600 (yourself) or line 31800 (dependant) of T1 return.

- Amount: ~$9,000–$9,500 federal base (2025 indexed) + provincial.

- Software (TurboTax, Wealthsimple) auto-pulls if you link My Account.

No re-application needed unless condition changes significantly.

4. Open a Registered Disability Savings Plan (RDSP) – The Big Multiplier

- DTC approval is the key to unlock government grants/bonds.

- Steps:

- Choose a bank (RBC, TD, BMO all offer—compare fees).

- Open RDSP account (bring DTC notice + SIN).

- Contribute (even $1 triggers bond).

5. If Your Condition Worsens – Reassessment

- Impairment more severe? Request reassessment for earlier start date or new categories.

- Submit new T2201 (no fee) + doctor letter.

- Common: Add cumulative effects later → bigger retro.

6. Transfer to Family Member

- Low income? Transfer unused credit to spouse/parent/child (line 32600).

- No extra form—claim directly on their return.

7. Protecting Your Approval

- CRA may review randomly (audit)—keep doctor records 6+ years.

- Report major improvements (rarely reduces credit).

- Move provinces? Credit follows—notify CRA for provincial switch.

8. Stack with Other Benefits

- Child Disability Benefit: Monthly payments start auto (~$277/month).

- Medical expenses: Claim attendant care, devices retroactively.

- HATC: Up to $3,000 cash for home renos.

Real timeline example: Approved March 2026 → retro cheque May → RDSP open June → first grant October.

Many stop at “approved”—then miss RDSP grants worth more than the DTC itself over time.

Want help maximizing post-approval (RDSP setup, transfers, reassessments)? Our free review spots thousands in extras fast—no obligation. Send us a message to find out what you qualify for.

Fourteen: How DTC Stacks with EI, CPP & More (Bonus)

Good news: These programs are designed to work together—you can often receive multiple at once without one cancelling the other. Here’s the straightforward breakdown for 2025:

Disability Tax Credit (DTC) + CPP Disability (CPP-D)

- Completely independent programs (DTC = CRA tax credit; CPP-D = Service Canada monthly pension).

- You can get both simultaneously—no offset or reduction.

- Many people on CPP-D also claim DTC (and vice versa)—DTC approval can even help strengthen a CPP-D application by proving severe impairment.

- Stack benefit: DTC reduces your tax on CPP-D payments + unlocks RDSP grants.

Disability Tax Credit (DTC) + EI Sickness Benefits

- Yes, you can receive EI sickness (up to 26 weeks temporary support) while approved for DTC.

- DTC is a permanent tax credit; EI sickness is short-term income replacement.

- No direct interaction—EI sickness payments are taxable, and DTC can reduce tax owed on them.

- Note: If your condition becomes prolonged, transition to CPP-D or other long-term options.

All Three Together?

- Possible in overlap periods (e.g., waiting for CPP-D approval while on EI sickness and claiming DTC retroactively).

- Real example: Someone off work sick → EI sickness pays weekly → gets DTC approved → reduces tax on EI + opens RDSP → later switches to CPP-D seamlessly.

Bottom line: These aren’t “either/or”—stacking them maximizes support. Many leave money behind by not claiming all they’re entitled to.

Unsure what’s available in your situation? Our free assessment reviews everything—no obligation. Find out what you qualify for by sending us a message.

Fifteen: Key CRA Terms Glossary

Life-Sustaining Therapy

Auto-qualifier if you need at least 14 hours/week (averaged over months) on therapy to sustain life (e.g., insulin management for Type 1 diabetes, dialysis, chest physiotherapy for cystic fibrosis). Includes prep, monitoring, recovery.

Marked Restriction CRA's gold standard

Cannot do the activity at all, OR

Takes three times longer than average person of similar age, OR

Requires exceptional daily help/adaptation. Even with aids/medication—must be 90% of the time.

Notice of Determination

Official CRA letter confirming approval/denial. States start date, categories, and retro years. Keep forever—needed for RDSP, provincial claims.

Prolonged Impairment

Must have lasted (or expected to last) at least 12 continuous months. “Expected to last” allows approvals for progressive conditions.

Retroactive Adjustment

CRA reassessing past tax returns (up to 10 years) to apply DTC. Results in lump-sum refund cheque.

Significant Restriction

Less severe than marked—used only for cumulative claims. Takes considerably longer or requires help, but not 3x or 90%.

T2201 Disability Tax Credit Certificate

The official form—Part A (taxpayer) + Part B (medical practitioner certification). Only current version accepted.

Transfer of Credit

Approved person with low/no income can transfer unused credit to supporting spouse, parent, child, grandparent, sibling, etc. (line 32600 or dependant lines).

Understanding these terms is 80% of winning approval. Misuse one (like checking “sometimes” instead of 90%), and it’s denial city.

Still unclear on how they apply to you? Our free assessment translates your situation into CRA language fast.

Sixteen: Frequently Asked Questions (FAQ)

Still have questions?

Our zero-risk free assessment reviews your details confidentially—no obligation.

1. What exactly is the Disability Tax Credit (DTC)?

The DTC is a non-refundable federal tax credit that reduces income tax for people with severe and prolonged impairments (or their supporting family members). It can result in retroactive refunds up to $50,000+ and unlocks other benefits like RDSP grants.

2. Can I qualify for the DTC if I work full-time?

Yes—many approved people work full-time or part-time. Eligibility depends on your impairment’s impact on daily activities (marked restriction 90% of the time), not employment status.

3. Does getting the DTC affect CPP Disability, ODSP, or other benefits?

No—the DTC is independent and doesn’t reduce CPP-D, EI sickness, or provincial supports (except rare cases like Alberta AISH offsets). It often complements them.

4. What if my doctor refuses to sign the T2201 form?

Find another qualified practitioner (nurse practitioner, psychologist, OT, etc.—list in Picking the Right Medical Pro section). Bring examples of winning wording; many switch doctors successfully.

5. How far back can I claim retroactive refunds?

Up to 10 years if this is your first approval (back to 2016 for 2026 claims). CRA auto-adjusts if you check the box on T2201.

6. Can I claim the DTC for my child (under or over 18)?

Yes—for any age if they meet criteria. Under 18 adds supplement (~$5,900 federal). Over 18: transfer unused credit to parents if low income.

7. Is the DTC taxable income?

No—refunds and credits are tax-free cash.

8. How long does CRA take to process T2201 in 2025?

8–16 weeks average (longer during peaks). Check status via My Account or call 1-800-959-8281.

9. What if I was denied before—can I reapply?

Yes—new evidence, updated condition, or better wording often wins on reapplication or appeal.

10. Does the DTC automatically qualify me for the Canada Disability Benefit (CDB)?

Yes—if aged 18–64 and income-tested, DTC approval is the gateway for the $200/month CDB (starting July 2025).

11. Can I transfer the credit to my spouse or family?

Yes—unused amount transfers to supporting spouse/common-law, parents, children, siblings, etc.

12. What costs can I claim as medical expenses with DTC?

Doctor fees for T2201, attendant care, devices, therapy—retroactively.

13. Do I need taxable income to get a refund?

No—low/no income families transfer to supporters or get provincial top-ups.

14. Is there a difference for Quebec residents?

Quebec has solidarity tax credit boost instead of provincial DTC—often bigger for low-income.

15. Can mental health conditions qualify?

Yes—ADHD, anxiety, depression, PTSD commonly approve under mental functions (memory, adaptive, problem-solving).

16. What about Type 2 diabetes or chronic pain?

Type 2: if severe insulin management (14+ hrs/week). Chronic pain: often cumulative effects.

17. How do I open an RDSP after approval?

Take DTC notice to any bank—unlocks up to $3,500/year grants + $1,000 bond.

18. Does DTC help with home renovations?

Yes—unlocks Home Accessibility Tax Credit (up to $3,000 cash back).

19. Can I apply if I'm over 65?

Yes—no age limit, though some linked benefits change.

20. What if my condition improves?

Rarely affects past approvals; report major changes to CRA.

21. Is the doctor fee tax-deductible?

Yes—claim on medical expenses (line 33099/33199).

22. Can I submit T2201 digitally?

Yes—via My Account “Submit Documents” (faster processing).

23. Why do 70% of first applications get denied?

Usually vague wording—missing “90% of time” or cumulative details.

24. Does DTC affect EI or workers' comp?

No reduction—stacks freely.

25. Can immigrants or new residents apply?

Yes—if Canadian tax resident with SIN.

26. What if I don't file taxes regularly?

Still apply—DTC can trigger refunds even with zero income.

27. Is blindness or Type 1 diabetes auto-approved?

Near-automatic with proper certification.

28. How does cumulative effects work for milder conditions?

Two+ significant restrictions = 15+ hrs/week extra time/support.

29. Can I claim for past years I didn't file taxes?

Yes—CRA reassesses unfiled returns.

30. Still unsure if I qualify?

Have a question not covered here? Drop it in comments or book a free call—we answer fast.

Have a question not covered here? Drop it in comments or book a free call—we answer fast.

Seventeen: Resources & Official Links

Official CRA Resources

- T2201 Disability Tax Credit Certificate (latest PDF): https://www.canada.ca/en/revenue-agency/services/forms-publications/forms/t2201.html

- DTC Eligibility Guide & Examples: https://www.canada.ca/en/revenue-agency/services/tax/individuals/topics/about-your-tax-return/tax-return/completing-tax-return/deductions-credits-expenses/disability-tax-credit.html

- Submit Documents Digitally (My Account): https://www.canada.ca/en/revenue-agency/services/e-services/digital-services-individuals/account-individuals.html

- Tax Centre Addresses (for mailing T2201): https://www.canada.ca/en/revenue-agency/corporate/contact-information.html

- RDSP Information: https://www.canada.ca/en/employment-social-development/programs/disability/savings.html

RDSP Calculators & Providers

- Government RDSP Calculator: https://www.canada.ca/en/employment-social-development/programs/disability/savings/calculator.html

- Major Banks (all offer RDSPs): RBC, TD, BMO, Scotiabank, CIBC—compare fees online.

Provincial Revenue & Support Sites

- Ontario: https://www.fin.gov.on.ca/en/taxcredits/disability/

- Quebec (Revenu Québec): https://www.revenuquebec.ca/en/citizens/tax-credits/solidarity-tax-credit/

- British Columbia: https://www2.gov.bc.ca/gov/content/family-social-supports/people-with-disabilities

- Alberta: https://www.alberta.ca/aish.aspx (AISH program)

- Saskatchewan: https://www.saskatchewan.ca/residents/taxes-and-credits/tax-credits/disability-tax-credit

Support Organizations

- Autism Canada: https://autismcanada.org/

- Canadian National Institute for the Blind (CNIB): https://cnib.ca/

- Multiple Sclerosis Society of Canada: https://mssociety.ca/

- Mental Health Commission of Canada: https://mentalhealthcommission.ca/

Free Tools & Communities

- CRA My Account (track status): Register at http://canada.ca/my-cra-account

- Reddit r/PersonalFinanceCanada & r/Disability (real applicant stories—search “DTC”)

This guide + these links provide you everything needed to claim your credits confidently.

One last thing: If you’d rather skip the research and paperwork, our zero-risk service handles it all—includes the option for no upfront fees, pay only if you win. Send a message for your DTC credit and refund review. We sincerely look forward to helping you succeed.

Thank you for reading Canada’s most comprehensive DTC guide. Here’s to your approval and refund!

Eighteen: Zero-Risk Free Assessment – Get Help Today

You’ve made it this far—congrats! By now you know the Disability Tax Credit inside out: eligibility rules, exact T2201 checkboxes, doctor strategies, denial fixes, hidden hacks, real case wins, and your personal checklist.

Many Canadians use this guide to apply successfully on their own—and that’s awesome. You might be ready to download the form, book your doctor, and mail it today.

But here’s the truth most people discover too late:

- 70% of first applications get denied over tiny wording issues.

- Retroactive claims often miss extra years or transfers worth $10,000+.

- Appeals drag on months… unless you know the right template and timing.

- Coordinating doctors, tracking status, and filing adjustments takes dozens of hours.

That’s where we come in.

We handle everything for you—zero risk, no upfront fees.

How it works:

- Book a free 15-minute assessment (phone or video—no pressure).

- We review your situation, spot qualifying impairments (even ones you might miss), and estimate your exact refund.

- If we think you qualify, we’ll manage the entire process: doctor coordination, perfect T2201 wording, submission, follow-ups, appeals if needed, and tax adjustments.

- You pay nothing unless approved and you receive money. Then only a percentage of the refund (industry standard—far less than leaving money on the table).

Thousands of families have trusted us to turn “maybe” into cheques worth $15,000–$50,000+. No lottery, no hassle—just results.

You’ve made it this far—congrats! By now you know the Disability Tax Credit inside out: eligibility rules, exact T2201 checkboxes, doctor strategies, denial fixes, hidden hacks, real case wins, and your personal checklist.

Many Canadians use this guide to apply successfully on their own—and that’s awesome. You might be ready to download the form, book your doctor, and mail it today.

But here’s the truth most people discover too late:

- 70% of first applications get denied over tiny wording issues.

- Retroactive claims often miss extra years or transfers worth $10,000+.

- Appeals drag on months… unless you know the right template and timing.

- Coordinating doctors, tracking status, and filing adjustments takes dozens of hours.

That’s where we come in.

We handle everything for you—zero risk, no upfront fees.

How it works:

- Book a free 15-minute assessment (phone or video—no pressure).

- We review your situation, spot qualifying impairments (even ones you might miss), and estimate your exact refund.

- If we think you qualify, we’ll manage the entire process: doctor coordination, perfect T2201 wording, submission, follow-ups, appeals if needed, and tax adjustments.

- You pay nothing unless approved and you receive money. Then only a percentage of the refund (industry standard—far less than leaving money on the table).

Thousands of families have trusted us to turn “maybe” into cheques worth $15,000–$50,000+. No lottery, no hassle—just results.

Ready to skip the stress and maximize your claim?

Have a question not covered here? Drop it in comments or book a free call—we answer fast.

You’ve got nothing to lose and potentially tens of thousands to gain. Let’s get you what you’re entitled to.

Disability Tax Credit (Canada): Get up to Fifty thousand dollars back.

Contact Us for a DTC credit refund review.

Nineteen: Disclaimer

While many succeed on their own with this guide, 70% of first applications get denied due to subtle CRA rules. We help fix denials or handle everything—no risk. Contact us for a review of your situation.

This guide is copyright DisabilityTaxRefund.ca. All rights reserved.

DIY or Done-For-You? Get your free eligibility check now.

Ready to DIY? Great—use this guide and good luck!

But if you’d rather skip the stress, denials, and months of waiting…

Let us do it all for you. Free assessment. No upfront fees. You have the option for contingency or pay as you go. With contingency, we only get paid (a percentage) if you get approved and receive money.

..Thousands of Canadians trust us to maximize their claim—often finding extra years or transfers they missed -making our service definitely worth it.

Book your free call now.